The insurance industry is a complex and dynamic sector that requires much attention and careful management to remain successful. With numerous policies and regulations, and many clients to manage, insurance companies must keep track of a lot of data to operate efficiently. This is where Enterprise Resource Planning (ERP) comes into play.

In this blog post, we will discuss what ERP is, why it is essential for insurance companies, and the benefits of implementing ERP software Oman for Insurance Brokers.

What Is ERP?

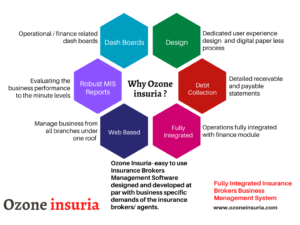

Enterprise Resource Planning (ERP) is a comprehensive software system that integrates and manages all business processes and operations, from finance and accounting to customer management. ERP systems provide a unified platform for businesses to manage their operations, streamline processes, and improve efficiency.

ERP Insurance Sector

Insurance companies must manage a vast amount of data, from customer information to policy details, to financial records. This data must be accurate, up-to-date, and easily accessible to employees across different departments. An ERP system provides insurance companies with a centralized platform to manage all their data, automate processes, and gain insights into their operations.

Need Of An ERP For Insurance Broking Companies

Insurance companies may struggle with disparate systems, manual processes, and data silos without an ERP system. This can result in a lack of visibility into business operations, poor decision-making, and reduced efficiency. For insurance companies to remain competitive, they must embrace technology and invest in an ERP system that provides real-time visibility into their operations.

Different Areas Of Insurance Industries That Require An ERP System

- Financial Management: An ERP financial management system can help insurance companies streamline their financial management processes, including accounts payable and receivable, general ledger, and financial reporting.

- Policy Management: An ERP system can help insurance companies manage policies, claims, and renewals. With an ERP system, insurance companies can automate policy administration tasks, reduce errors, and improve customer service.

- Customer Relationship Management: An ERP system can help insurance companies manage customer relationships, including sales, marketing, and customer support.

Challenges Of The Insurance Sector Without An ERP System

Insurance companies that do not have an ERP system in place may face several challenges, including:

- Poor Data Management: Without an ERP system, insurance companies may struggle to manage data across different departments and systems, resulting in data silos, errors, and inconsistencies.

- Inefficient Processes: Manual and disparate systems can result in inefficient operations, delayed decision-making, and increased costs.

- Compliance Risks: The insurance industry is heavily regulated, and with an ERP system in place, insurance companies may be able to comply with regulations, resulting in compliance risks and penalties.

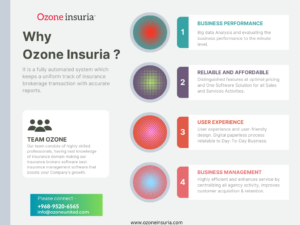

ERP Benefits For Insurance Broking Companies

- Improved Efficiency: An ERP system can help insurance companies streamline operations, reduce manual processes, and improve efficiency.

- Real-time Visibility: An ERP system provides real-time visibility into business operations, allowing insurance companies to make informed decisions, identify issues, and improve efficiency.

- Better Compliance: An ERP system can help insurance companies comply with regulations, reducing compliance risks and penalties.

- Cost Reduction: An ERP system can help insurance companies reduce costs by streamlining processes, reducing errors, and improving efficiency.

Implementing An ERP System At Your Insurance Broking Companies

Here are some steps to follow when implementing an ERP system:

- Define your goals and objectives: Define your goals and objectives for implementing an ERP system. Identify the areas of your business that need improvement and the benefits you expect from implementing an ERP system.

- Evaluate ERP vendors: Evaluate different ERP vendors and software solutions to find the one that best meets your business needs. Look for vendors with experience in the insurance industry and offer features such as policy administration, claims management, and financial management.

- Train your employees: Train your employees on how to use the ERP system effectively. Provide ongoing training and support to ensure employees are comfortable using the system and can use its features.

- Monitor and evaluate: Monitor and evaluate your ERP system regularly to ensure it meets your goals and objectives. Make adjustments as needed to improve performance and maximize the system’s benefits.

Conclusion

In conclusion, ERP software Oman can be a game-changer for insurance companies looking to streamline operations, improve efficiency, and remain competitive in a rapidly evolving industry. With the right ERP system, insurance companies can automate processes, improve data management, and gain real-time visibility into their operations. By implementing an ERP system, insurance companies can improve customer service, reduce costs, and enhance compliance, ultimately leading to a smarter and more successful business.